Employee benefits and future pension costs were indeed figured into the pay raise plan adopted in September, City Manager Jim Pennington said in response to questions posed by Peachtree City Councilwoman Kim Learnard about the recently-adopted Condrey and Associates pay and classification study.

The council passed the pay raise with a contentious 3-to-2 vote, overturning a 2 percent inverse pay hike approved just two months before.

Pennington also denied that there was any conflict of interest involving the group of city employees who chose the pay raise consultant and who subsequently benefitted from the adopted pay increases.

The answers pertaining to Learnard’s Oct. 5 request were not listed as an agenda item for the Nov. 6 meeting by press time, though Pennington did respond to the request with an Oct. 27 letter. Pennington at the Oct. 16 council meeting said the information was being compiled and would be presented.

Learnard in her information request took the position that she would like to discuss “some of the information that has not yet been presented. Since the taxpayers will be footing the bill this must be made public in the form of a ‘discussion’ item.”

Condrey and Associates in the study indicated that it did not include benefit costs, Learnard said. She then referenced remarks by Human Resources Director Ellece Brown during the Condrey study presentation that the figures do include benefit costs. Learnard asked which is correct.

Pennington in his response said Brown stated that the cost figures in the study did not include benefit costs and the cost projections were only accurate at the point in time when human resources provided consultants with the then-current list of employees, job titles and salaries.

“Of course, both titles and salaries have now changed in accordance with the Condrey recommendations. Also, the Condrey spreadsheet where the total implementation costs were derived included some duplicate positions which were removed. The duplicate positions were included in the Condrey spreadsheet because we had filled some of these with new hires, but Condrey had no way of knowing that,” Pennington said. “In other words, Human Resources ‘scrubbed’ Condrey’s spreadsheet and Finance added benefits costs for the Oct. 2 meeting. As you may recall, (Brown) explained that our memo to council at that meeting was correct. (Finance Director) Paul Salvatore also explained to council in the meeting how the correct total implementation costs were derived.”

On an associated question, Learnard asked for a comparison to the six cities in the survey that had employees contributing a percentage of their salaries to their city’s retirement fund.

In his multi-part response, Pennington first addressed where Peachtree City stood in terms of being above or below the average. The city has better benefits in health insurance, dental insurance, retirement benefits for public safety employees (vesting in fewer years and no reduction in benefits for early retirement) and general employees (vesting in fewer years), life insurance and the number of holidays.

Pennington said Peachtree City is below the mean/average in dental insurance, vision insurance, retirement for public safety employees (retirement age is greater than the mean), retirement benefits for general employees (retirement age is greater than the mean), short-term disability, personal leave days, sick leave time and tuition reimbursement.

Addressing the question further, Pennington said the six cities that had employees contributing a percentage of their salaries to their city’s retirement fund are cities that have public safety employees contributing to their pension plan. Additionally, said Pennington, the survey shows that 11 employers do not have public safety employees contributing to their pension plans.

Another question posed by Learnard asked for the total cost of the pay increase and where the money to fund it would come from.

Pennington in response said the total cost is the $910,425 previously reported. Of that amount, $270,071 came from the previously-approved inverse pay plan which was not implemented on Oct. 1 due to the Condrey study while the remaining $640,354 was projected to come from unappropriated reserves.

Following up on future costs, Learnard asked about the long-term impact on the retirement fund in the next several years.

Pennington said prudent funding for a pension plan assumes anticipated raises as one of the assumptions used in the actuarial computation of annual contributions.

“Our actuary was provided the figures we used to implement the new pay plan and was asked to run some calculations to determine the impact. He concluded that by 2015 the relative cost of the pension plan would be $20,714 less than what was expected/planned for 2015 and that by 2016 the relative cost would be $504 less than what was expected/planned for 2016,” said Pennington. “In short, the pay increases that were approved by the council were no more (and slightly less) than those already anticipated by the defined benefit pension plan through the use of prudent assumptions used for funding calculations.”

Looking further out in time, Learnard asked for a five-year budget projection containing the new pay rates and all related benefit costs. She asked that Pennington provide an example of how the new plan could be implemented without a tax increase or using reserves.

“Could it be done (without a tax increase or using reserves), yes, but not without short- and long-term consequences,” Pennington said.

Pennington said looking at the city’s organizational structure and the ability to meet citizens’ needs and concerns, he would be hard-pressed to recommend any cuts other than maintaining current personnel controls in terms of filling vacant staff positions.

“As you are aware, the city has a long-standing practice of utilizing salary savings from vacant positions to assist in our development of fund reserves and this is built into our financial models,” said Pennington. “However, the decision to cut or modify programs is a policy issues and requires discussion by council.”

Pennington said the issue of no tax increases in the future would have to be premised on a significant increase in property values and local option sales tax revenues.

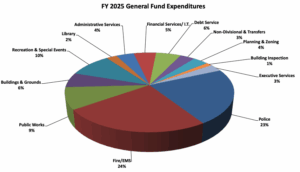

Pennington said Salvatore has prepared an updated five-year model that addresses the use of $1.059 million in reserves for the FY 2015 general fund while maintaining a 29 percent budget reserve. Figures provided by Salvatore showed that amount needed to balance the budget decreasing to $339,698 in FY 2016. The need to use reserve funds to balance the budget continues to decrease to approximately $282,000 in FY2017 and $264,000 in FY 2018. The figures show a surplus of $125,000 in FY 2019 with using reserves.

The Citizen also posed questions to Pennington.

One of those stated the appearance that the recently-adopted pay and classification study did not take the cost of future pensions into account.

“Yes, the cost of future pensions was taken into account. The defined benefit plan was funded over the last several years at a level to prevent an unacceptable impact on the plan and the planning was correct. Our finance director and fund actuary were on target,” Pennington said.

Asked by The Citizen why the study did not consider the value of employee benefits, Pennington responded saying the study did include benefit costs.

“That is incorrect. We specifically asked that the study include such an analysis. The analysis and correlation of benefits to salary were critical and significant factors in the overall study and our eventual recommendation,” Pennington said, referencing pages 19-24 of the study.

Pennington was asked by The Citizen if it was a conflict of interest to have employees serve on a committee that would be recommending pay increases, including one employee who will reportedly receive a 26 percent increase.

“Absolutely not, the committee did not make any pay increase recommendations nor did they have the authority to do so, nor did they have any involvement in the Condrey salary and classification recommendations,” Pennington said.

Pennington was also asked why employees served on the committee and if the process could have been handled differently to exclude the people who would be benefitting from the results of the study.

“I wanted buy-in by the employees due to issues that had occurred in the past; therefore I determined that an employee from every division would be selected to serve on the review committee,” Pennington said. “This, by the way, is not a new process nor a self-serving one for the employees, but solid contemporary management practice that I have used before. Their function was to review the proposals and make a recommendation to me. Once I received their recommendation, I reviewed all six of the proposals and after checking references concurred with the recommendation. It should be noted that this was not a bid but rather a proposal which is evaluated on a point schedule.”

Leave a Comment

You must be logged in to post a comment.